Breaking Borders: How Foreign National Loans Empower International Investors in Real Estate Markets

Foreign national loans are tearing down the financial barriers that once kept global investors at bay, offering a golden key to the lucrative U.S. real estate market. Imagine the possibilities when international borders no longer dictate where you can invest and grow your wealth.

An Overview of Foreign National Loans

Foreign National Loans offer non-U.S. citizens the opportunity to invest in the U.S. real estate market. These loans provide numerous benefits, including access to diverse real estate markets and the ability to leverage financing opportunities.

By securing a foreign national loan, international investors can expand their investment portfolio and tap into the potential for long-term returns in the U.S. Additionally, real estate professionals can benefit by catering to the growing demand for foreign national loans, enhancing their client base, and establishing themselves as experts in this specialized segment of the market.

Foreign National Loans: Eligibility and Requirements

These loans have specific eligibility criteria and requirements that must be met in order to qualify.

Some common eligibility requirements include having a valid passport and a valid visa or lawful residency status in the United States.

Additionally, lenders may require proof of income and assets, as well as a down payment. Credit history and employment stability are also important factors that lenders consider.

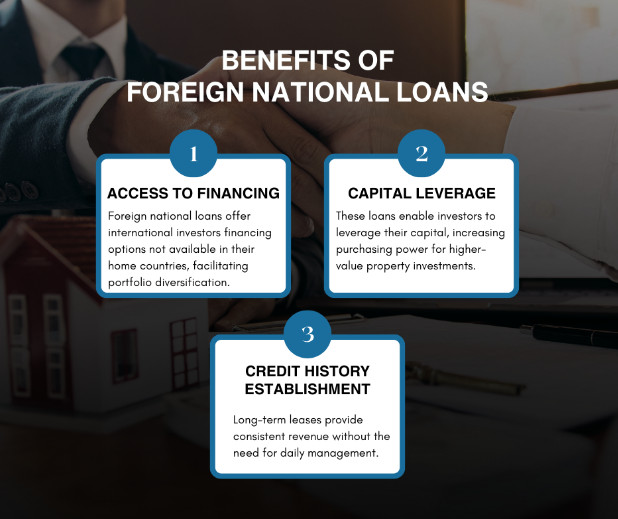

Advantages of Foreign National Loans for International Investors

Foreign national loans provide several advantages for international investors in the real estate market. These loans offer access to financing options that may not be available in their home countries, allowing them to diversify their investment portfolio.

They also enable investors to leverage their capital and increase their purchasing power, making it possible to invest in higher-value properties.

Moreover, foreign national loans help investors establish a credit history in the United States, which can be beneficial for future investments and financial opportunities.

Key Considerations for Foreign National Loans in Real Estate Investment

When considering foreign national loans for real estate investment, there are several key considerations to keep in mind. These include:

- Documentation requirements: Non-U.S. citizens may need to provide additional documentation, such as a valid passport, visa, and proof of income, to qualify for a foreign national loan.

- Down payment: Foreign national loans often require a higher down payment than conventional mortgages. It is important to assess your financial capabilities and plan accordingly.

- Repayment terms: Foreign national loans typically have shorter repayment terms, which means higher monthly payments. Evaluating your cash flow and determining if you can comfortably manage the payments is essential.

- Interest rates: Due to the perceived higher risk associated with non-resident borrowers, foreign national loans usually come with higher interest rates. Conducting thorough research and comparing loan options is crucial to securing favorable terms.

- Finding an experienced lender: Working with a knowledgeable and experienced lender specializing in foreign national loans can help provide the best loan terms.

Key Takeaways and Future Trends in Foreign National Real Estate Investment

Foreign National Loans are a valuable financing tool for international investors in the real estate market. The key takeaways from this article are as follows:

- Foreign national loans provide access to diversified real estate markets beyond one's home country, allowing investors to explore opportunities worldwide.

- These loans offer competitive rates and tailored financing options, enabling investors to leverage their investment potential.

- Foreign national loans differ from traditional mortgage options and have unique eligibility requirements.

- Real estate professionals can benefit from understanding and catering to the needs of international investors.

- The future trends in foreign national real estate investment point towards continued growth and increasing demand for cross-border opportunities.

FAQs About Foreign National Loans

Foreign national loans may raise some questions for potential borrowers. Here are some frequently asked questions about foreign national loans:

Can I get a foreign national loan without a Social Security number?

Yes, some lenders offer foreign national loans without requiring a Social Security number. Instead, they may request a taxpayer identification number or an Individual Taxpayer Identification Number (ITIN).

Are the interest rates for foreign national loans higher than conventional mortgages?

Interest rates for foreign national loans may be slightly higher than conventional mortgages due to the higher risk associated with non-U.S. citizens. However, rates can vary depending on the borrower's financial profile and the lender's terms.

Can I use a foreign national loan to purchase investment properties?

Yes, foreign national loans can be used to purchase both primary residences and investment properties. However, the specific terms and loan-to-value ratios may differ for investment properties.

Are foreign national loans available for commercial properties?

Yes, some lenders offer these loans specifically for commercial properties. These loans may have different requirements and terms compared to residential loans.