Investments

There are many different kinds of investments you can make; stocks, gold, real estate, business etc.

Stocks, for example, represent ownership in a publicly traded company. When you buy a stock, you are essentially purchasing a small piece of the company and are entitled to a portion of its profits and assets. Stocks can be bought and sold on stock exchanges and their value can rise and fall based on a variety of factors such as company performance, economic conditions, and market sentiment.

Gold, on the other hand, is a tangible asset that has been used as a store of value for thousands of years. It is often considered a hedge against inflation and a safe haven investment in times of economic uncertainty. Gold can be bought in various forms such as coins, bars, and ETFs (exchange-traded funds).

Real estate investing can involve purchasing property with the intention of renting it out for income or selling it for a profit. Real estate can be a lucrative investment, but it can also be a significant commitment in terms of time, money, and resources.

Investing in a business can be a great way to become involved in the operations and growth of a company. This can take the form of starting your own business, investing in a small business, or buying shares in a publicly traded company. However, it can also be a riskier investment as the success of the business is dependent on a variety of factors.

Ultimately, the best investment strategy will depend on your individual financial goals, risk tolerance, and investment timeline. It is important to do thorough research and seek the advice of a financial professional before making any investment decisions.

Below you'll find some more interesting investment information.

Investments

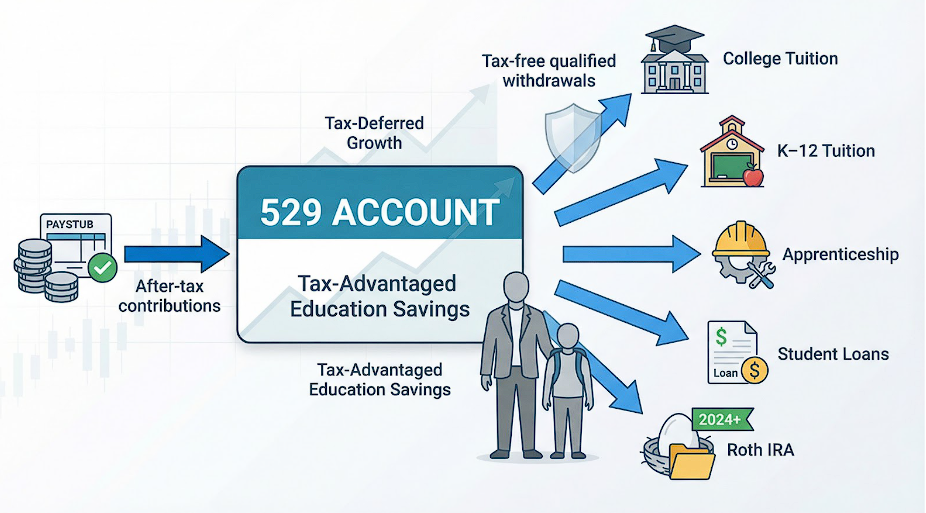

529 basics and the new 2026 rulebook

January 21, 2026A 2026 guide to the best 529 plans for Massachusetts residents, including new IRS rules, tax deductions, fees, and Morningstar-rated plans. Compare the 7 best 529 plans for Massachusetts…

Read More

Investments

Foundation Instability Erodes Rental Asset Value And Financing Options

January 04, 2026Structural settlement creates hidden financing risk. Learn how to document, repair, and keep rental properties financeable. Discover how foundation movement…

Read More

Investments

The Rising Interest in Gold and Coin Collecting Across the U.S.

November 05, 2025Discover why gold and coin collecting is rising across the U.S. Economic trends, inflation, and renewed interest in tangible assets are driving Americans to invest in precious metals…

Read More

Investments

Real Estate Investors - Buying Properties Through an LLC

October 14, 2025Learn the top mistakes investors make when buying properties under an LLC, including financing challenges, legal missteps, and compliance issues-and how to avoid them…

Read More

Investments

From Tenant to Owner: Building Financial Foundations

October 01, 2025Learn how high-rent residents can accumulate wealth via physical assets, including gold coins, before or alongside property acquisition. Tangible assets differ from money spent on rent…

Read More

Investments

Marco Bitran on Real Estate Lessons Every Investor Should Know

September 24, 2025Marco Bitran shares essential real estate lessons—balancing profit with purpose, building strong teams, and playing the long game for lasting investment success…

Read More

Investments

Real Estate Investor Tools: Smarter Investment Decisions

June 24, 2025Discover essential tools for real estate investors to streamline property analysis, lead management, market research, and portfolio growth. The right technology can drive smarter…

Read More

Investments

Real Estate Investor Tools: Smarter Investment Decisions

April 24, 2025Discover essential tools for real estate investors to streamline property analysis, lead management, market research, and portfolio growth. The right technology can drive smarter…

Read More

Investments

From Real Estate to Real Returns: Smarter Investing Ahead

March 28, 2025Explore modern investing beyond real estate. Learn smarter strategies including AI stocks, ETFs, and tech investments for diversified portfolio growth and real returns in today's…

Read More

Investments

5 Key Benefits Of Investing In Multi-Family Real Estate

March 28, 2025Learn five key benefits of investing in multi-family real estate, from stable rental income to tax advantages, and learn strategies to maximize your returns…

Read More

Investments

5 Real Estate Investment Trends Shaping the U.S. Market in 2025

March 26, 2025Discover the top 5 real estate investment trends shaping the U.S. market in 2025, from smart tech and climate risk to mixed-use developments and sustainable investing…

Read More

Investments

Understanding Pre-Construction Condo Deposit Structures

March 25, 2025Learn about pre-construction condo deposit structures with Owncondo's expert breakdown. Understand payment plans, timelines, and key details to make informed investment…

Read More

Investments

Investing in Real Estate Without Owning Property

March 10, 2025Discover how Boston renters can invest in real estate without owning property. Explore REITs, crowdfunding platforms, ETFs, and other investment strategies to build wealth while maintaining rental…

Read More

Investments

Accelerating Deductions: A Guide for Real Estate Investors

March 05, 2025Maximize real estate tax savings by accelerating deductions! Learn cost segregation strategies to reduce taxable income, boost cash flow, and grow your investments…

Read More

Investments

Maximizing Investment Returns with Property Tax Strategies

February 28, 2025Maximize real estate profits with smart property tax strategies. Learn how deductions, 1031 exchanges, and exemptions can help you reduce tax liabilities and boost returns…

Read More

Investments

Fractional Real Estate Investing Explained

February 17, 2025Discover fractional real estate investing—how shared ownership lowers entry costs, enhances liquidity, and offers passive income. Learn key benefits, risks, and trends…

Read More

Investments

Real Estate Investment Opportunities in Boston

January 28, 2025Explore real estate investment opportunities in Boston, including rental properties, house flipping, and commercial ventures. Learn strategies for success in this thriving market…

Read More

Investments

How To Buy a Second Home and Rent the First

December 10, 2024Learn how to buy a second home while renting out your first. Discover essential tips on financing, property management, tax considerations, and creating a profitable real estate…

Read More

Investments

Why Boston Is Attracting Property Investors From Across the US

November 05, 2024Discover why Boston is a hotspot for property investors across the U.S. Explore its strong economy, high rental yields, booming tech sector, and steady property value appreciation, making it …

Read More

Investments

Should You Pay Off Your Rental Mortgage or Buy New Property?

October 25, 2024Discover whether paying off your rental property mortgage or buying a new property is the best choice for maximizing your real estate investment. Explore the pros, cons, and financial…

Read More

Investments

Building Wealth Brick by Brick: Essential Tips for Property Investors

September 08, 2024Property investment, market trends, location selection, portfolio diversification, financing, property evaluation, rental property management, legal considerations…

Read More

Investments

6 Common Mistakes in Property Fund Management

September 02, 2024Successful property fund management requires a clear strategy, thorough research, balanced leverage, proactive property and tenant management, and robust risk management…

Read More

Investments

Why the EB-5 Program Is an Attractive Option for Investors

August 09, 2024The EB-5 program grants foreign investors a pathway to U.S. residency and citizenship through investment in job-creating businesses. If you're considering immigration to the USA…

Read More

Investments

How to Calculate ROI on a Rental Property

August 09, 2024Learn how to calculate the Return on Investment (ROI) for a rental property, including determining initial investment, calculating annual rental income, subtracting annual operating…

Read More

Investments

6 Mistakes to Avoid When It Comes to Real Estate Investing

July 28, 2024Avoid 6 common real estate investing mistakes to maximize success: poor market research, overlooking property condition, underestimating expenses, ignoring financing options…

Read More

Investments

Value-Adding Investment: Does a Greenhouse Add Value

July 18, 2024Greenhouses can add value to commercial properties by boosting market value, offering energy savings, promoting sustainability, enhancing aesthetics, and providing versatile uses…

Read More

Investments

Do You Own a Mobile Home? Here's How to Make Some Cash on it

June 27, 2024Mobile homes offer various ways to make money, from renting them out to using them for storage or unique event spaces. Collaborate with real estate agents who need temporary housing…

Read More

Investments

The Pros of Investing in a Condo for Rental Use

May 28, 2024Condos can be a good investment for rental properties due to lower costs, desirable locations, and less maintenance compared to single-family homes…

Read More